Insight

Insights

In-depth analysis from our expert teams

Orbit Podcast

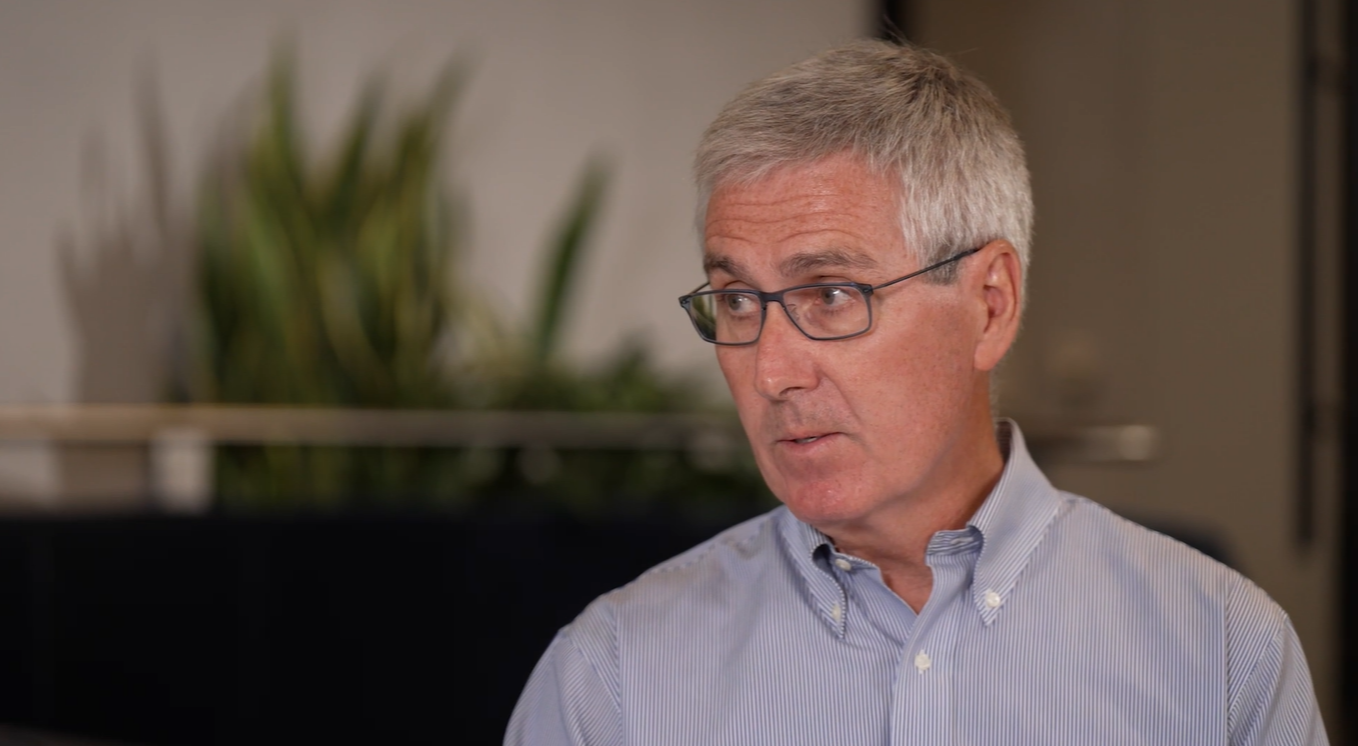

AI, Control Points, and the Next Wave of Vertical SaaS with Tidemark Capital founder, Dave Yuan

Insight

"In a world of software abundance, all that matters is taste"...

Insight

The AI Development Revolution

Orbit Podcast

Refounding in the face of AI with Des Traynor of Intercom

Insight

Redesigning the Customer Journey with an AI-first Mindset

Insight

Securing the Future: AI-powered cybersecurity strategies

News

Hg strengthens executive team with promotions and CIO appointment

Orbit Podcast

A golden age of software engineering with Russell Kaplan of Cognition

News

IFS valued at €15 billion in minority stake sale

News

Hg private wealth offering surpasses $1 billion

News

smartTrade Announces Strategic Investment from TA alongside CEO and Management

News

P&I secures further backing from Hg in €5.5 billion transaction

Orbit Podcast

Quick and dirty prototypes with Andrew Ng

News

Scopevisio partners with Hg to accelerate growth in DACH region

Insight

Hg's Silicon Valley Leadership Summit

Insight

Tara Anand Carter on the Innovators' Exchange podcast

News

Trackunit Announces Investment from Goldman Sachs Alternatives

Insight

Taking a triangulated approach to monetising GenAI

Orbit Podcast

A glimpse of the next generation: Zoe Zhao and Annalise Dragic of Azlin Software

Insight

Customer experience: from cost-center to revenue generator

Insight

Alan Cline's 2025 Outlook with PE Hub

News

Citation welcomes new investment from HarbourVest Partners

News

Hg tops AGC's total deal counts ranking for 2024

Insight

Septeo: La Success Story

News

Florian Brokamp establishes new consortium for insurance brokers

Orbit Podcast

Incubate, experiment and implement: the real business case for AI today

News

IRIS Software Group Announces Intent to Acquire Dext Software Ltd.

Orbit Podcast

Risk-taking & resilience with Sukhinder Singh-Cassidy, CEO of Xero

News

Empyrean Solutions Secures Significant Investment from Hg

News

Septeo Group welcomes new investors Téthys Invest and GIC

Insight

GenAI: the land of the bold & brave

Orbit Podcast

Vulnerability as strength in business: Nick Mehta of Gainsight

Orbit Podcast

Thousands of small experiments: Merete Hverven of Visma

Orbit Podcast

The art of pattern recognition: Darren Roos of IFS

Insight

Auditboard and Hg featured in Business Insider

News

Ncontracts acquires Venminder via Hg buyout

Orbit Podcast

Do tech leaders have to be tech experts?: Elona Mortimer-Zhika of IRIS

Insight

The Power of Unity: how European insurance brokers can harness technology and thrive

Insight

Alan Cline speaks at GrowthCap Forum

Orbit Podcast

The business case for AI: Brent Hayward of Salesforce, David Carmona of Microsoft & Nagraj Kashyap of Touring Capital

Insight

Benedikt Joeris discusses GGW Group with Finance Magazin

News

CTAIMA and e-coordina join forces

News

Sofina invests in team.blue

Orbit Podcast

The greatest tech comes when we ignore ROI: Raghu Raghuram of VMware

Insight

Navigating risks to reap the rewards of AI

News

team.blue welcomes new investment from CPP

News

Hg joins the CyberFirst programme

Orbit Podcast

Mastering the billion-dollar software playbook: Joe Lonsdale of 8VC & Eric Poirier of Addepar

News

F24 to accelerate growth with new investment from Altor

Insight

Software Leadership Gathering 2024: Shifting Techtonics

News

Matthew Brockman joins Daybreak Europe at Bloomberg

Insight

Electricity in the air: a journey to the frontier of GenAI

News

AuditBoard agrees to be acquired by Hg for over $3 billion

Insight

We're only laying the foundations: a Digital Summit Conversation

News

CUBE acquires global regulatory intelligence businesses from Thomson Reuters

News

CUBE acquires Reg-Room

News

Hg strengthens executive team with six senior appointments

News

Hg completes its investment into GGW

Insight

Inspiration to Innovation: Ensuring success of AI in your product

News

Focus Group secures new investment from Hg

Insight

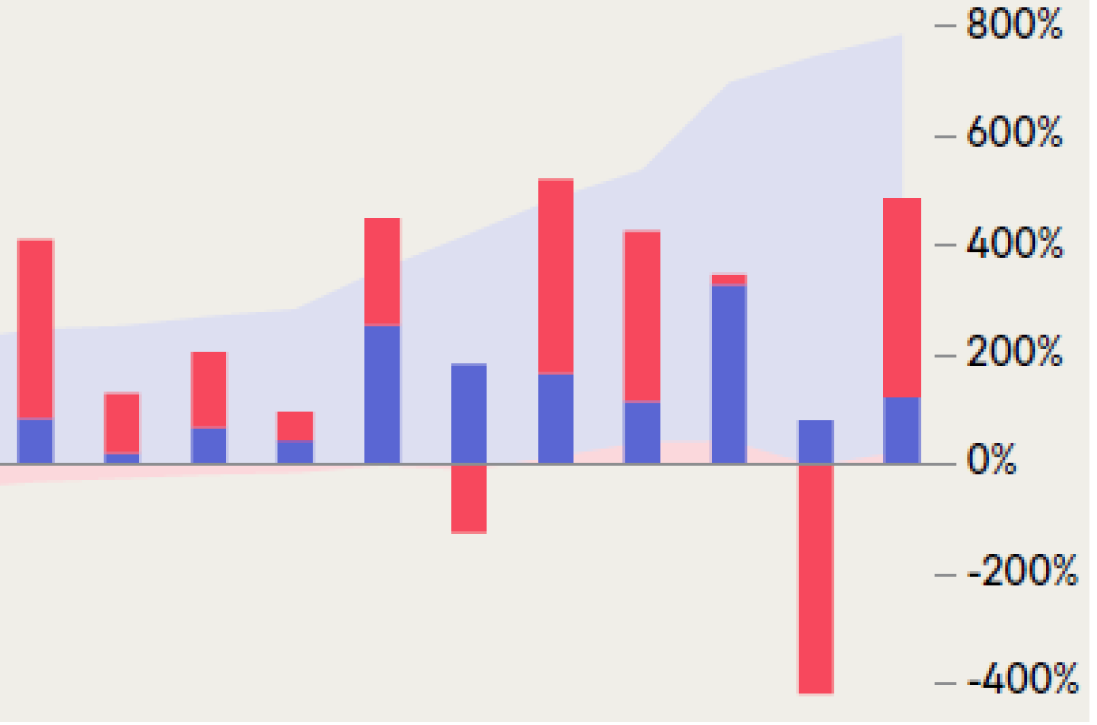

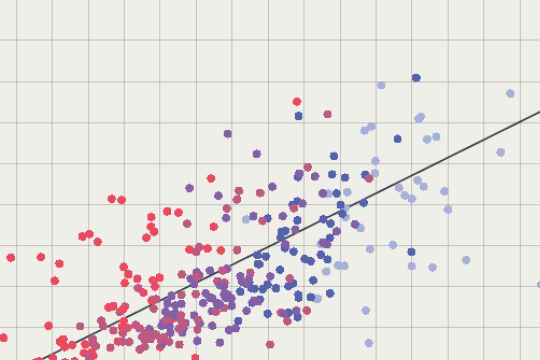

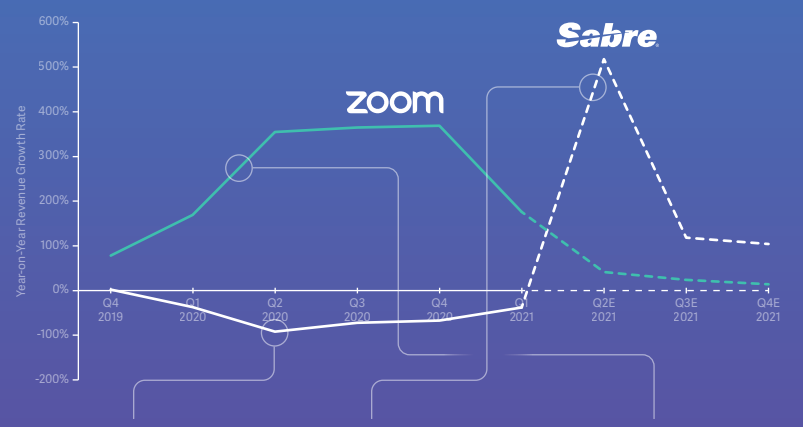

David and David review David’s NRR analysis. What’s the recurrent theme?

Insight

40 years of Gen AI at Hg

Insight

The AI Squared Enterprise: AI, Automation, Integration

News

CUBE and Hg unite to create regulatory compliance and risk platform

Insight

Hg’s Steven Batchelor: You can be IRR and MOIC driven

Insight

Gen AI will revolutionize software. Now what?

News

Induver and Clover join forces alongside Hg

Insight

Alan Cline speaks on Growth Investor

Insight

Recruiting for potential: Tim Barker speaks to Ideagen COO, James King

Insight

Hg and Visma featured in the Financial Times

News

Argus announces strategic transaction to support next phase of growth

Insight

Nic Humphries discusses Visma on Business Breakdowns

Insight

Alan Cline: 'The AI revolution is real'

News

Hg closes sale of MeinAuto Group divisions to the Renault Group

News

IRIS Software Group secures major US investment from Leonard Green & Partners

News

Visma attracts new investors for further international expansion in a transaction valuing the company at EUR 19 billion

News

Hg tops AGC Partner's list for tech deals done in 2023

News

CINC Systems secures meaningful strategic investment from Hg

News

GGW Group secures investment from Permira as the firm scales as a leading insurance brokerage group in Europe

Orbit Podcast

What drives business quality in an era of AI and digital platforms?: Jonathan Knee of Evercore

News

Hg launches Fusion

News

JTL secures investment from Hg to fund further growth as a European champion in e-commerce software

Insight

Earnings growth wins every time

Orbit Podcast

Pace of innovation

Orbit Podcast

Harnessing a new superpower

Orbit Podcast

LLM AI, the fourth pillar of software

News

Visma strengthens position as Europe’s cloud accounting champion with acquisition of Silverfin

Orbit Podcast

Life as a service

News

Farouk Hussein joins Hg in North America

News

ECI Partners invests in Commify, Europe's leading provider of business messaging solutions to Local Enterprises

News

Nomadia secures investment from Hg

News

Paul Zuber joins Hg in North America

Orbit Podcast

Insuring the insurers

Orbit Podcast

Future ancestors

News

Azets Group secures investment from PAI Partners to join Hg and support next phase of growth

News

Staying ahead: AI takeaways from Hg's Senior Leadership Gathering 2023

News

Hg goes top 10 in the PEI300

Orbit Podcast

The modern data stack

News

GTreasury secures investment from Hg to accelerate growth as a global Treasury Management Software platform

Insight

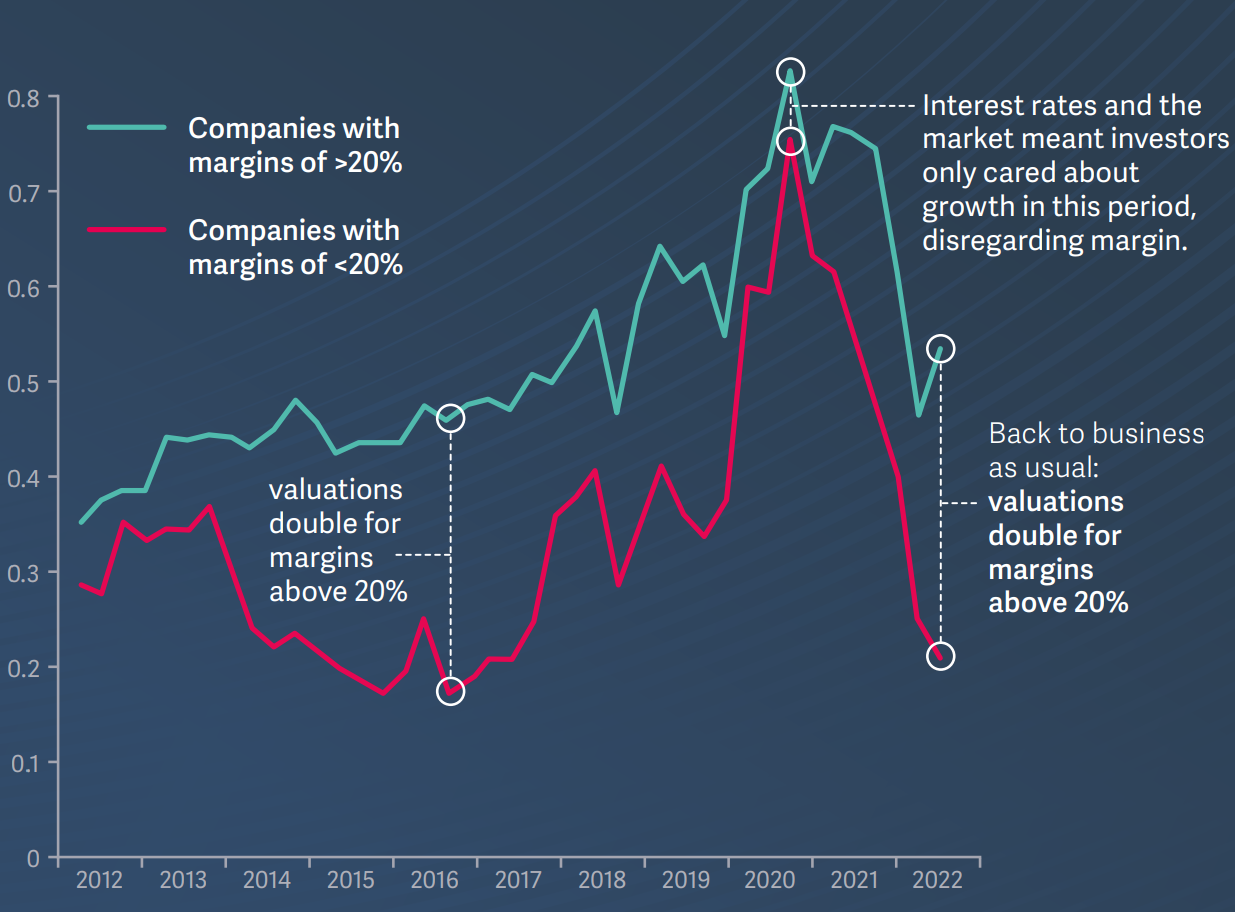

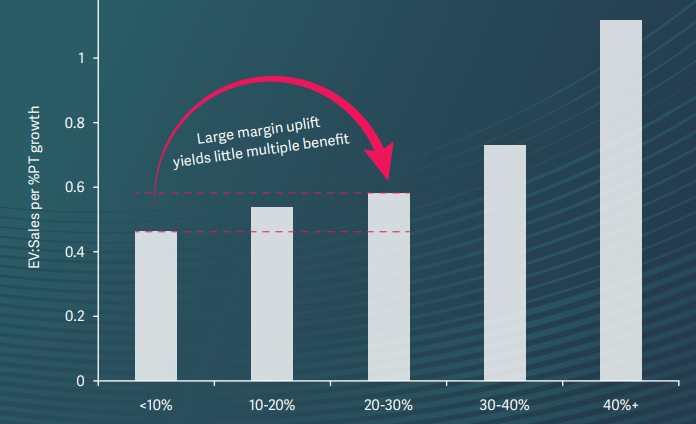

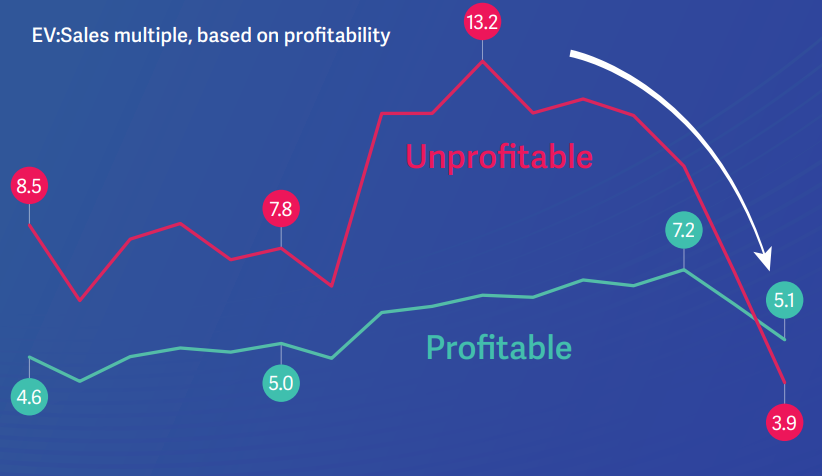

Striking the balance: the tradeoff between growth and margin

News

Built to last: why a narrow focus is the secret to Hg’s success

News

A fresh look for Hg

News

Hg to build out dedicated wealth team

Orbit Podcast

What does AI mean to you?

News

Alan Cline joins Hg as Head of North America

Insight

Cooler heads continue to prevail

News

AGC Partners ranks Hg as #1 most active tech investor

Orbit Podcast

Investors in Enduring Growth

News

Hg agrees to sale of Transporeon for €1.88 billion

Insight

The trade-off between growth and margin

Orbit Podcast

Poacher turned gatekeeper

Insight

A Love Letter to ESRI

Orbit Podcast

The Pace of Automation

News

Ideagen and ProcessMAP to combine their strengths to create a world-leading health and safety software solution

News

TrustQuay secures Hg investment to further accelerate its vision to digitalise the Trust, Corporate and Fund Service sector

Orbit Podcast

Insurance, the O.G. Data Business

Insight

Legaltech Cloudspotting

Orbit Podcast

Building a Growth Engine

Orbit Podcast

Unravelling the Orthodoxy

News

Cornerstone VC reaches first close of £20m fund to back UK tech start-ups led by diverse teams

Orbit Podcast

To be of Value

News

Intelerad announces significant investment from TA to accelerate growth

Orbit Podcast

Sustainable IT and IT for Sustainability

News

Ideagen secures partnership with Hg to support further growth as a regulatory and compliance software leader

News

team.blue strengthens leadership team and prepares for further expansion

News

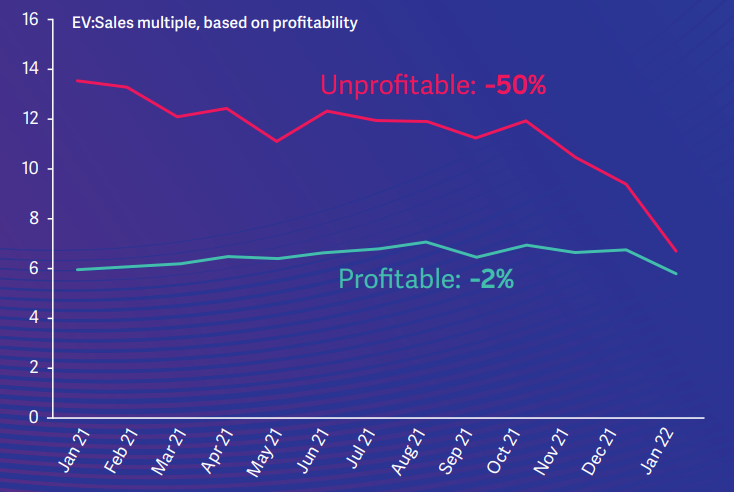

The profitable vs. unprofitable trend continues

News

Norstella announces agreement to merge with Citeline

Orbit Podcast

Unlocking real-time behavioral data in SaaS

News

Hg agrees sale of MEDIFOX DAN to ResMed for US$1bn

News

Howden Group creates new $30bn force in global broking through landmark TigerRisk deal

News

The Access Group announces substantial investment to drive continued expansion at £9.2 billion valuation

News

Hg agrees the sale of itm8 to Axcel

News

The Hg Foundation appoints James Turner as its first CEO to scale its charitable activities within education and technology across the UK, Europe and U

Insight

Tech meltdown? David Toms Chart of the month

News

The Hg Foundation backs Merit America to help low-wage workers access careers in tech

Orbit Podcast

Why Tech is Deflationary in an Inflationary World

News

Hg strengthens executive team

News

LucaNet AG partners with Hg to build a global leader in Corporate Performance Management

News

Hg invests in IFS and WorkWave

News

Ukraine – an update from Hg

Orbit Podcast

The Feedback Loop - Part 2

Orbit Podcast

The Death of Email? - Part 1

Orbit Podcast

The Digital Construction Site

News

The Hg Foundation forms a €750,000 partnership with The Technical University of Munich

Orbit Podcast

Never a better time than now

News

Hg Joins Private Equity Industry’s First-Ever ESG Data Convergence Project Alongside Milestone Commitment of Over 100 LPs and GPs

News

Waystone completes investment from Montagu and announces new strategic investment from Hg

Orbit Podcast

The Future of SaaS - Part 2

News

ProcessMAP partners with Hg

News

AGC Partners ranks Hg as #1 most active tech acquirer

News

Fonds Finanz secures investment from Hg

News

Pirum Systems secures new investor to accelerate its global growth strategy

Insight

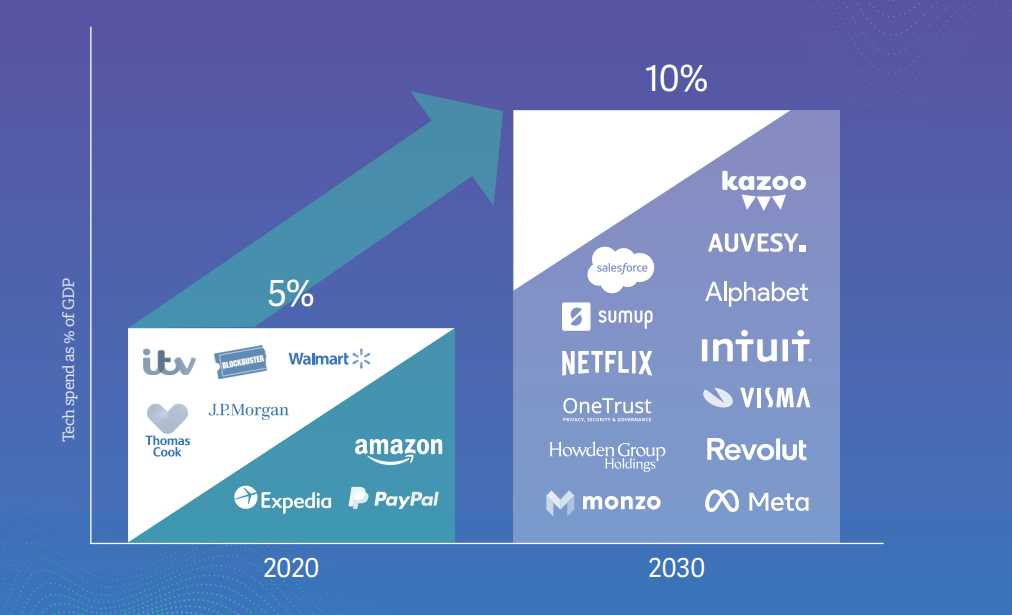

Tech spend is forecast to double Insight over the next decade, but how?

News

Revalize secures significant minority investment from Hg

Orbit Podcast

The Future of SaaS - Part 1

News

Hg in group of seven pioneering firms representing €133bn AUM to combat climate change by setting ambitious science-based targets

News

Litera secures further investment from Hg

News

Hg joins leading investors committing to net zero

Orbit Podcast

Data Science in Drug Development

Orbit Podcast

You are only as strong as your weakest point

News

Hg signs $5bn+ in Healthcare Technology

News

Leading global software investor offers STEM scholarships in Salford

News

Generation France and The Hg Foundation announce €1m+ new tech-focused partnership

Orbit Podcast

The Art of Cross-sell

Orbit Podcast

“I choose me”

Orbit Podcast

Purpose vs Profit

News

BrightPay and Relate Software join forces to create an accounting & payroll software champion

News

Trackunit and ZTR come together to connect construction

News

HHAeXchange and healthcare investor Cressey & Company welcome strategic investment from software investor, Hg, to accelerate continued growth as the leading homecare management solution provider

News

Visma attracts new Nordic and international investors as part of a strategic expansion of the shareholder base, valuing the business at €16 billion

Insight

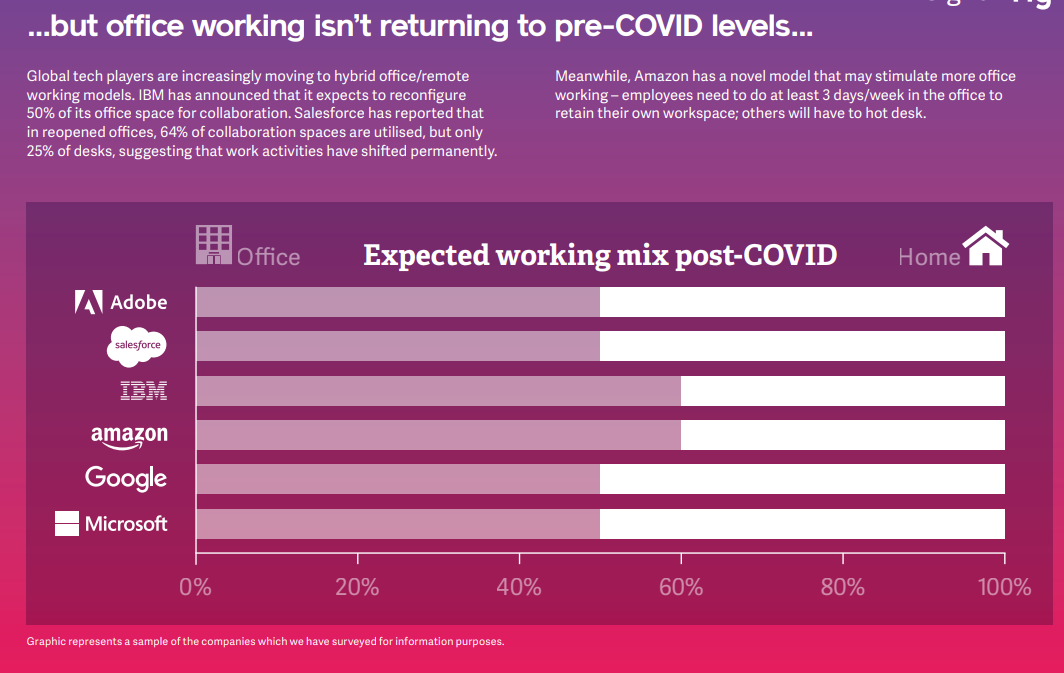

Back to the office?

News

Riskalyze Recapitalised by Hg

News

Serrala secures strategic investment from Hg

News

MMIT and Evaluate Join Forces to Offer an End-to-End View of the Pharmaceutical Market Landscape

News

Hg invests in MDT

Orbit Podcast

Respond, React & Adapt

News

insightsoftware attracts c.$1bn strategic investment from Hg

Orbit Podcast

Born in the Cloud

News

Hg agrees the sale of Allocate to RLDatix

Orbit Podcast

Volcano Cat Bonds and Other Innovations

Orbit Podcast

The Scandinavian Question

Orbit Podcast

Navigating Change in US Tech

Insight

A relatively absolute Insight performance…

News

upReach and The Hg Foundation announce major new partnership

News

Hg invests in AUVESY to support the business’ leading position in the growing industrial automation sector

News

Trackunit attracts strategic investment from Hg to further accelerate the company’s journey to eliminate downtime in construction

News

Mitratech Announces Strategic Investment from Ontario Teachers’

News

Visma: one of Europe’s most inclusive companies

News

Hg sells Trace One to Symphony Technology Group

Insight

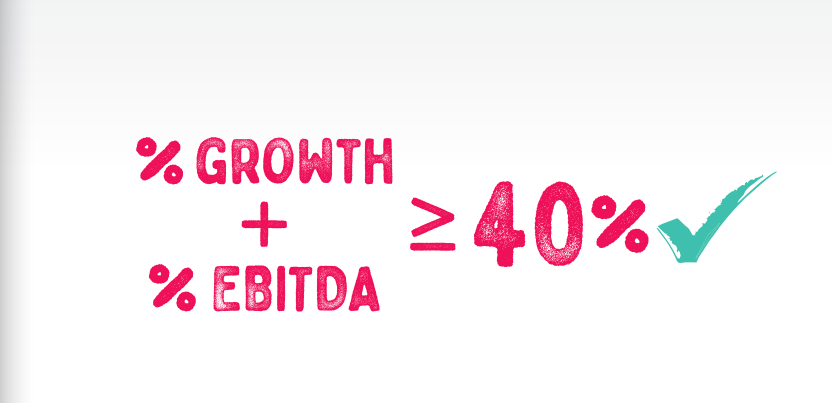

What happened to the "Rule of 40"?

News

Bloomberg TV interviews Nic Humphries and Matthew Brockman

News

Two World-Leading Impact and Sustainability Funds Invest in Benevity, Accelerating the Movement to Drive Corporate Purpose

News

The Hg Foundation partners with SEO Tech Developer

News

Hg invests in Prophix to continue to scale the business and invest further in product and technology

News

Hg invests in Geomatikk Group

News

Benevity announces investment from Hg to continue to strengthen corporate purpose globally

News

Hg invests in The Septeo Group to help continue building a leading LegalTech platform across Europe

News

Gen II gains significant new investment from Global Investors to fuel continued long-term expansion

News

Hg agrees the sale of Eucon to VHV Group

News

Hg agrees the sale of STP to Bregal Unternehmerkapital

News

CaseWare announces strategic investment from Hg

News

The Access Group reports growth and substantial investment for expansion

News

Hg invests in Hyperion in a transaction valued at $5 billion

News

Hg announces the sale of A-Plan Group

News

Hg announces new investment in The Citation Group

News

Hg leads further majority investment in Visma valued at US$12.2 billion in the world’s largest ever software buyout

News

Sovos to gain new investment

News

Hg announces KKR investment in The Citation Group

News

The launch of The Hg Foundation

News

Private: Hg in the USA

News

Committing to action on climate change with iCI

News

Hg invests in F24

News

Silverfin announces investment led by Hg to accelerate international growth

News

COVID-19 update: Resources and information from across the Hg portfolio

News

Hg strengthens executive team with four Partner promotions

News

Hg invests in smartTrade Technologies

News

MediFox and DAN Produkte merge to create MediFox DAN Group

News

Hg invests in Intelerad Medical Systems

News

IRIS: Inside one of the UK’s most prolific business software providers

News

Hg Saturn Fund acquires cloud-based HR software provider P&I from Permira funds

News

A Year in Review

News

Hg Carbon Footprint Report 2020/21

News

Litera Microsystems Acquires Workshare

News

Register Group joins team.blue

News

IRIS Software Group enters definitive agreement to acquire FMP Global

News

Rhapsody and Corepoint merge to advance Interoperability in Healthcare

News

Hg invests in TransIP to join forces with Combell

News

Hg invests in Litera Microsystems

News

Hg purchases Cinven stake in Visma

News

Hg further strengthens global executive team and opens office in New York

News

Hg Invests in Transporeon Group

News

Hg agrees the sale of Foundry

News

Hg succeeds Waterland as investor in Combell Group

News

Megabuyte50 Awards honour Commify, Foundry, Access Group, IRIS, FE & Allocate Software

News

Hg announces final closing of Hg Saturn 1 Fund at £1.5bn

News

Hg announces an investment in BrightPay

News

Hg announces investment into Allocate Software from Hg8 Fund

News

Syneos Health™ acquires Kinapse

News

Hg Invests in Orion Health Rhapsody and Population Health Businesses

News

Hg invests in IT Relation

News

Hg agrees sale of Intelliflo to Invesco

News

Visma Group intends to acquire Raet

News

Hg Saturn Fund makes new joint partnership investment in IRIS with ICG

News

Hg agrees sale of JLA to Cinven

News

Hg makes strategic investment in FE

News

Hg invests in MediFox

News

Hg agrees sale of Teufel to Naxicap Partners

News

Hg agrees sale of Radius to Vistra

News

Hg agrees sale of Allocate Software to Vista Equity Partners

News

The Access Group announces strategic investment from Hg

News

Hg announces acquisition of Mobility Concept

News

Hg investment in DADA S.p.A

News

Hg invests for the future by strengthening executive team

News

Hg announces investment in MeinAuto.de

News

Hg receives definitive binding offer from Itiviti to acquire Ullink

News

Megabuyte50 Awards honour Foundry, IRIS and Esendex

News

Hg agrees sale of Sequel to Verisk Analytics

News

Hg leads $5.3bn buyout of Visma

News

Hg announces an investment in Esendex

News

Hg sells Zitcom Group to Intelligent

News

Hg announces sale of Parts Alliance to Uni-Select

News

HgCapital announces sale of QUNDIS to KALORIMETA

News

Hg announces an investment in Mitratech

News

Hg builds for the future by strengthening executive team

News

HgCapital announces the final closing of HgCapital 8 and Mercury 2

News

HgCapital announces sale of Zenith to Bridgepoint

News

IRIS Software Group acquires PS Financials

News

HgCapital Mercury announces a significant investment in fundinfo AG

News

HgCapital announces investment in Evaluate

News

CogitalGroup which is backed by HgCapital announces an investment in Baldwins and the launch of the new Group

News

HgCapital announces investment in STP Group

News

HgCapital returns 36% IRR from the sale of Personal & Informatik to Permira funds

News

HgCapital further strengthens the executive team

News

HgCapital announces an investment in Visma BPO

News

Launch of CogitalGroup, a new advisory services business

News

HgCapital’s Mercury Fund sells Relay Software to Applied Systems

News

HgCapital agrees to sell SFC KOENIG to IDEX

News

HgCapital builds for the future by strengthening executive team

News

HgCapital announces investment in Raet

News

HgCapital announces investment in Trace One

News

HgCapital announces investment in Citation

News

HgCapital announces investment in Kinapse

News

HgCapital announces investment in Sovos Compliance

News

HgCapital announces investments in Zitcom and ScanNet

News

Hellman & Friedman acquires controlling interest in TeamSystem

News

EidosMedia receives new investment from HgCapital

News

HgCapital agrees sale of SimonsVoss to Allegion

News

HgCapital invests in The Foundry

News

HgCapital announces investment in Eucon

News

HgCapital-backed software champions shine at the inaugural megabuyte50 awards

News

The Parts Alliance recognised in international M&A awards

News

Equistone sells A-Plan Insurance to HgCapital

News

e-conomic joins forces with Sweden’s SpeedLedger

News

e-conomic and CE Consulting create a new force in Spanish accounting software

News

Parts Alliance acquires Unipart Automotive branches and jobs

News

HgCapital announces investment in Sequel Business Solutions

News

HgCapital announces investment in Relay Software

News

HgCapital announces fifteen internal promotions

News

Visma, valued at NOK 21 billion, widens shareholder base

News

Nair & Co. and High Street Partners merge to create Radius

News

HgCapital announces acquisition of Ullink

News

Successful pricing of Manx Telecom plc IPO

News

HgCapital agrees investment in Zenith

News

HgCapital completes maiden investment from Fund 7 with acquisition of Personal & Informatik AG

News

HgCapital announces sale of Epyx

News

HgCapital acquires e-conomic, Europe’s leading SaaS business for SME’s

News

HgCapital acquires Nair & Co.

News

HgCapital announces substantial investment in Intelliflo

News

HgCapital announces sale of ATC

News

HgCapital announces sale of CSH

News

HgCapital announces substantial investment in Valueworks

News

HgCapital announces the sale of SHL

News

HgCapital announces investment in QUNDIS Group

News

Kai Romberg is promoted to Partner

News

Another senior appointment to the Services team

News

Nic Humphries appears on FT.com’s Deals & Dealmakers

News

HgCapital expands its Services team

News

HgCapital is UK PE Firm of the Year

News

HgCapital announces the intended sale of Mondo Minerals

News

HgCapital announces the sale of SLV Group

News

HgCapital announces the sale of SiTel

News

News HgCapital and ATC Group announce investment

News