Insights

In-depth analysis from our expert teams

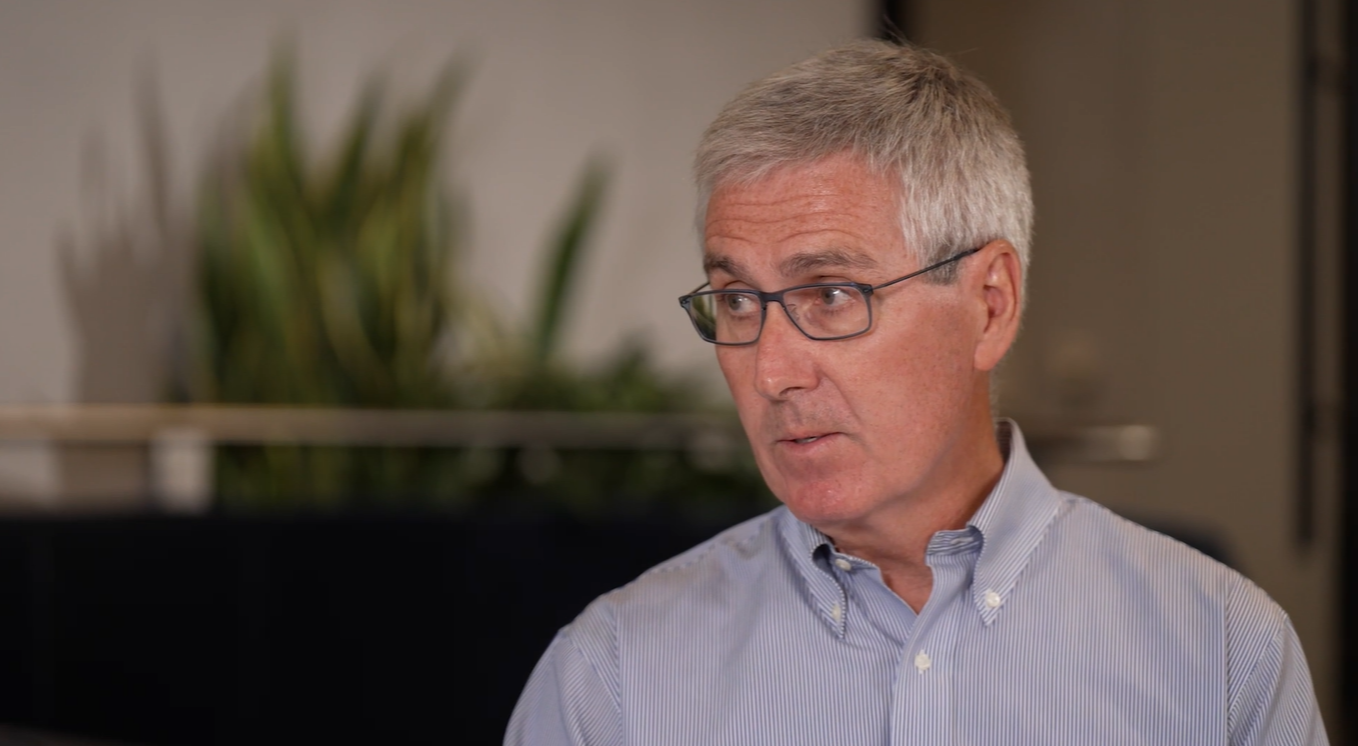

Orbit: An Hg Podcast

Ep. 35:

What drives business quality in an era of AI and digital platforms?

Time for a conversation with one of the greats. As Professor of Finance and Economics at Columbia, former senior banker at both Morgan Stanley and Goldman Sachs, and currently Senior Advisor at Evercore Partners, Jonathan Knee’s thinking is held in high regard across the business world.

His recent book, ‘The Platform Delusion’, dismantles the long-held belief that a platform business which provides connections rather than creating products is inherently valuable.

So how should we assess business quality in this new era of AI & platforms? Mr Knee outlines the fundamental drivers which haven’t changed in the face of new technology and applies them to assessments of Uber vs Airbnb, Etsy vs Amazon and, of course, how does this all relate to vertical software where we at Hg spend our time.

Orbit episodes

Latest news & insights

News

Hg completes its investment into GGW as the firm scales as a leading insurance brokerage and MGA group in Europe

Read articleNews

Focus Group secures new investment from Hg to accelerate its position as a leading technology provider for SMEs

Read articleNews

CUBE and Hg unite to create industry defining regulatory compliance and risk platform

Read articleNews